Davis Global ADR SMA

Portfolio Commentary

Winter Update 2024

Portfolio Commentary

Winter Update 2024

Key Takeaways

- The MSCI ACWI (All Country World Index) gained 22.20% in 2023, largely driven by U.S. equities which outperformed international stocks despite a number of domestic headwinds.

- The Davis Global ADR SMA portfolio is built around a highly selective list of well-researched businesses with very attractive characteristics based on bottom-up stock selection guided by some long-tailed themes in the global markets.

- Looking forward, we believe our overall portfolio positioning is advantaged given its low starting valuations, comparatively high earnings growth potential, and the competitive and financial strength of the underlying holdings.

Market Perspectives:

Moving to Different Cycles

In 2023 the MSCI ACWI returned 22.20%. Its performance was driven by strong returns among U.S. equities while international shares lagged by comparison. The strength of the U.S. market reflects economic developments that are mostly positive. Gross domestic product continues to grow at approximately 3%, the unemployment rate is extremely low at 3.7%, and inflation appears to be tapering from recent highs. Still, it is worth noting that U.S. equities advanced in 2023 despite a number of headwinds and uncertainties that included fears of a potential near-term recession, the implications and impact of a regional banking crisis from early last year, and two major wars.

International markets have lagged the U.S. in recent years for reasons that are largely regional in nature. In Europe, inflation and interest rates remain elevated. As such, the European Central Bank has maintained its tightening stance with respect to interest rates, and there appear to be growing signs of a slowdown in some of the larger European economies. That said, we see numerous attractive opportunities in European markets, in which we are investing selectively.

In Asia-Pacific, China has been slow to find its economic footing after a very prolonged shutdown due to COVID, a fact that has weighed on the growth rate of the entire region. While China’s recovery has required patience, we firmly believe its economic activity level and vibrancy will improve in the foreseeable future, and that this is a moment to consider owning Chinese equities. To put the present opportunity into perspective, Chinese equities today have rarely been cheaper in our estimation, both in absolute and relative terms. Given this, we have seen net purchasers of China-related stocks at the margin.

With country markets moving according to different cycles, different geographies are out of step with one another. In 2023 our U.S. holdings on balance were in bloom and we have pared some of the more successful investments in recent months. Meanwhile, we are taking advantage of low prices in foreign markets, particularly in Asia-Pacific.

Portfolio Review:

Long-Tailed Themes, Best-of-Breed Stocks

In 2023 the Davis Global ADR SMA portfolio delivered double-digit positive results, trailing the benchmark somewhat but still representing progress in long-term wealth building.

In terms of overall positioning, the portfolio is built around a highly selective list of well-researched businesses and its characteristics are very attractive, in our view.

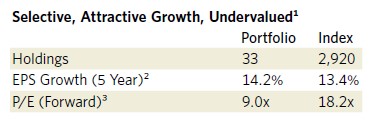

In the following table we compare the portfolio with the index with respect to three key metrics—the number of holdings, five-year trailing average annual earnings per share growth rate, and the average forward price-to-earnings (P/E) multiple.

With 33 portfolio holdings, we are capitalizing on the opportunity as active managers to own only what we feel are best-of-breed companies with attractive future prospects. In contrast, the unmanaged index is rather indiscriminately allocated across thousands of names, most of which we consider less attractive. Within reason and subject to diversification considerations, we believe that owning fewer holdings and focusing on what we deem superior companies can be an advantage versus the passive alternative.

Our five-year earnings per share growth rate demonstrates the level of historical growth that our businesses have been able to achieve on balance. Relative to the benchmark, the portfolio has generated higher earnings per share growth rates even while its P/E is much lower than that of the index.

In our experience, this combination of selectivity, low starting valuations, and long-term earnings growth can provide an attractive balance of risk and reward and can combine to deliver powerful results over the long term.

50/50 Regional Mix

The portfolio is comprised of both U.S. and international stocks with the proportions of the two being roughly equal at 50% each.

The U.S. (at 50% of the portfolio) is by far our largest regional exposure. Asia-Pacific is the next largest allocation (23% of the total), followed by Europe (17%), and then finally the last 10% representing smaller allocations to other areas of the world. These allocations are driven primarily by stock selection and reflect, in general, where we are finding opportunities today.

In addition to stock selection, we are guided at the portfolio management level by long-tailed themes where we can concentrate our research efforts. In effect, this means that we seek to “fish where the fish are” in terms of broad areas of the global market. Three of the primary themes running through the Davis Global ADR SMA portfolio include: (1) high-grade financials, (2) a broad swath of technology companies, and (3) healthcare.

Within financials, we favor competitively advantaged, very durable financial institutions in multiple geographies, including the U.S., Asia-Pacific and Europe. One of our financial holdings in the U.S. is Wells Fargo which is slowly but surely building value for shareholders by generating healthy cash earnings and growing book value in solid fashion over time. While the company is still a contrarian name, it is one of the cheapest mega-banks in the U.S., with a strong balance sheet, reasonably high capital ratios, and proven management. This gives it a degree of optionality which could prove a significant boost to our thesis if the yield curve improves or regulators lift the asset cap they imposed on the bank in 2018.

“In the short term, …share price declines… reflect the malaise in China’s economy… Longer-term, we expect the region’s general level of economic activity, e-commerce traffic and broader consumption trends to improve markedly...”

In Europe, we hold shares of Swiss bank Julius Baer which is going through somewhat of a transition. Despite some negative headlines in recent periods, we like Julius Baer’s core private banking franchise which is sticky and highly profitable, as well as its cheap valuation currently.

In Bermuda we sold our position in Bank of Butterfield on strength during the last quarter of 2023.

Technology, the second principal theme running through the Davis Global ADR SMA portfolio, spans multiple areas including: e-commerce, social media, online search, cloud computing, and semiconductor-related companies.

Two consumer-oriented technology holdings that we like today are JD.com and Coupang, both in Asia- Pacific. In the short term, both companies’ share price declines in the last year reflect the malaise in China’s economy post-COVID lockdowns, among other factors. Longer-term, we expect the region’s general level of economic activity, e-commerce traffic, and broader consumption trends to improve markedly, however unknowable the exact timing may be. In the meantime, we are very comfortable owning these types of businesses. They have strong competitive positions and extraordinarily cheap valuations for what are normally high-growth profit models, and we expect that their sectors should do well over time relative to other areas of the market.

Within healthcare, we are investing primarily in generics manufacturers as well as healthcare services and are focusing mostly on the U.S. market at this time. We recently added Quest Diagnostics, a leading independent lab and testing company in the U.S. at what we feel is an attractive valuation. The base business is solid, in our view, given its nearly ubiquitous footprint across the U.S., its low cost of growth, the stickiness associated with mass scale delivery of lab services, and its comparative cost advantage versus the far more expensive hospital labs in this country.

In addition to the above themes, we have many individual positions that are rather unique and do not fall neatly into a broader theme per se. Whether grouped by theme or based on more stand-alone theses, note that we select all of our investments on a case-by-case, company-by-company basis according to a single, clear-minded investment philosophy and discipline.

Outlook:

Advantaged Positioning

The global stock market is really a market of many individual stocks from which investors can pick and choose. We are exercising extreme selectivity to maximize what we believe are the most attractive opportunities across regions. In addition, we believe the overall positioning of the Davis Global ADR SMA portfolio is advantaged given a rare combination of low starting valuations (in absolute and relative terms), comparatively high earnings growth potential, and the overall competitive and financial strength of the underlying holdings.

In conclusion, as stewards of our clients’ savings our most important job is growing the value of the funds entrusted to us. With more than $2 billion of our own money invested alongside that of our clients, we are on this journey together.4 This alignment with our clients is uncommon in our industry; our conviction in our portfolio of carefully selected companies is more than just words.

We are grateful for your trust and well-positioned for the future.

The performance of mutual funds is included in the Composite. The performance of the mutual funds and other Davis managed accounts may be materially different. For example, the Davis Global Fund may be significantly larger than another Davis managed account and may be managed with a view toward different client needs and considerations. The differences that may affect investment performance include, but are not limited to: the timing of cash deposits and withdrawals, the possibility that Davis Advisors may not buy or sell a given security on behalf of all clients pursuing similar strategies, the price and timing differences when buying or selling securities, the size of the account, the differences in expenses and other fees, and the clients pursuing similar investment strategies but imposing different investment restrictions. This is not a solicitation to invest in the Davis Global Fund or any other fund.

Effective 9/23/14, Davis Advisors created a Global Equity SMA Composite which excludes the institutional accounts and mutual funds. Performance shown from 10/1/14, through the date of this report, the Davis Advisors’ Global Equity SMA Composite includes all eligible wrap accounts with no account minimum from inception date for the first full month of account management and includes closed accounts through the last day of the month prior to the account’s closing.

A time-weighted internal rate of return formula is used to calculate performance for the accounts included in the Composite. The net of fees rate of return formula is calculated based on a hypothetical 3% maximum wrap fee charged by the wrap account sponsor for all account services. For the gross performance results, custodian fees and advisory fees are treated as cash withdrawals.

Davis Advisors is committed to communicating with our investment partners as candidly as possible because we believe our clients benefit from understanding our investment philosophy and approach. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate.

This report discusses companies in conformance with Rule 206(4)-1 of the Investment Advisers Act of 1940 and guidance published thereunder. Six companies are discussed and are chosen as follows: (1-4) current holdings based on December 31 holdings; (5) the first new position; and (6) the first position that is completely closed out. Starting at the beginning of the year, the holdings from a Global Companies model portfolio are listed in descending order based on percentage owned. Companies that reflect different weights are then selected. For the first quarter, holdings numbered 1, 6, 11, and 16 are selected and discussed. For the second quarter, holdings numbered 2, 7, 12, and 17 are selected and discussed. This pattern then repeats itself for the following quarters. If a holding is no longer in the portfolio then the next holding listed is discussed. Each of these holdings must come from a different country. None of these holdings can be discussed if they were discussed in the previous three quarters. If there were no purchases or sales, the purchases and sales are omitted from the report. If there were multiple purchases and/or sales, the purchase and sale discussed shall be the earliest to occur. Other than the recent buy and sell, any company discussed must constitute at least 1% of the portfolio as of December 31.

The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to buy or sell any particular security. There is no assurance that any of the securities discussed herein will remain in an account at the time this report is received or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of any account’s portfolio holdings. It should not be assumed that any of the securities discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. It is possible that a security was profitable over the previous five year period of time but was not profitable over the last year. In order to determine if a certain security added value to a specific portfolio, it is important to take into consideration at what time that security was added to that specific portfolio. A complete listing of all securities purchased or sold in an account, including the date and execution prices, is available upon request.

The investment objective of a Davis Global Equity account is long-term growth of capital. There can be no assurance that Davis will achieve its objective. Davis Advisors uses the Davis Investment Discipline to invest a client’s portfolio principally in common stocks (including indirect holdings of common stock through depositary receipts) issued by both United States and foreign companies, including countries with developed or emerging markets. The global companies strategy may invest in large, medium, or small companies without regard to market capitalization. The principal risks are: China risk, common stock risk, depositary receipts risk, emerging markets risk, exposure to industry or sector risk, fees and expenses risk, foreign country risk, foreign currency risk, headline risk, large-capitalization companies risk, manager risk, mid- and small-capitalization companies risk, and stock market risk. See the ADV Part 2 for a description of these principal risks.

We gather our index data from a combination of reputable sources, including, but not limited to, Lipper, Wilshire, and index websites.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets throughout the world. The index includes reinvestment of dividends, net foreign withholding taxes. Investments cannot be made directly in an index.

Item #3818 12/23 Davis Advisors, 2949 East Elvira Road, Suite 101, Tucson, AZ 85756 800-717-3477, davisadvisors.com